Last year, we saw the merger between Oppo and OnePlus in the Chinese market, as OnePlus officially announced that its flagship OnePlus 9 series will be sporting Oppo’s ColorOS instead in the China smartphone market. It seems that the merger has started to bear fruit, as with the early release of the OnePlus 10 Pro, OnePlus 9RT, and Oppo Reno7 series in China with ColorOS, Oppo(with OnePlus) has managed to snag the top spot for China smartphone shipment market share in Q1 2022.

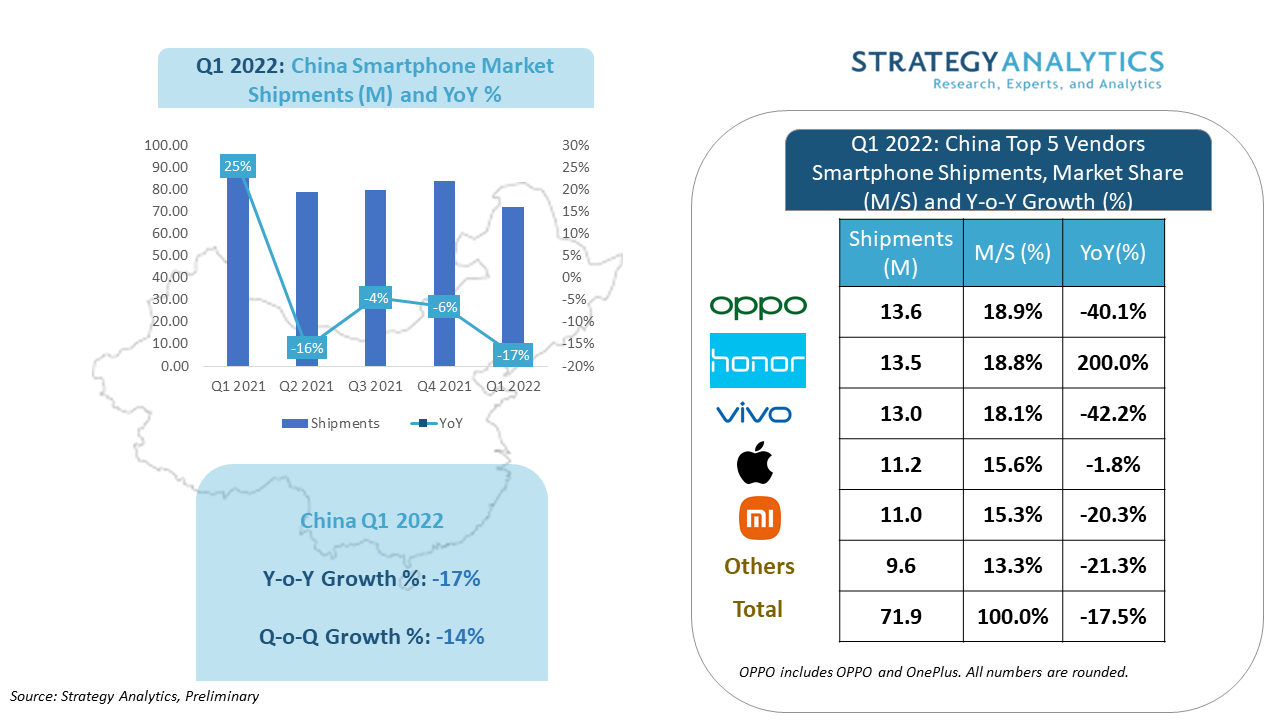

This news story comes from a report from Strategy Analytics, as the statistics firm reports that the Chinese smartphone market had shrunk by -17% year-on-year in Q1 2022 amid the lockdowns in China. The firm reports that 71.9 million units of smartphones were shipped in China during Q1 2022 and the market was mostly dominated by these top 5 renowned smartphone brands in the country: Oppo (includes OnePlus), Honor, Vivo, Apple and Xiaomi.

These top 5 smartphone brands managed to capture 87% of the smartphone market in China in Q1 2022, up from 86% last year, and besides Honor, all the other 4 brands experienced negative growth this quarter.

Oppo(includes OnePlus)

Leading the smartphone market, Oppo, with assistance from its sibling brand, OnePlus has managed to snag the top spot of the smartphone market share in China with 13.6 million shipments in Q1 2022, accounting for 18.9% of the market. This success can be attributed to the tech giant’s release strategy of releasing many devices in late Q4 2021 and early Q1 2022 to ramp up sales during the first-quarter holiday seasons in China.

However, the brand is facing a sharp decline in growth as Oppo(with OnePlus) had experienced negative growth of -40.1% YoY when compared to Q1 2021. If the growth trend continues, the tech giant may lose the top spot next quarter.

Honor

Following the gradual exit of Huawei from the smartphone market, Honor was seen as a great alternative for users who were familiar with the Huawei ecosystem. With the release of its Honor 60, Honor X30 and Honor Magic4 series of smartphones, the brand was able to capture the entry-level, mid-range, and flagship market with its brand catalogue.

Thus, it comes as no surprise that the Honor brand has risen to 2nd place in the Chinese market, with 13.5 million shipments in Q1 2022, and a market share of 18.8%. In addition, the brand is also experiencing positive YoY growth, as it grew 200% when compared to Q1 2021. If the trend continues, Honor is expected to top the Chinese smartphone market share next quarter.

Vivo

Vivo is another smartphone brand under the BBK tech conglomerate in China. The smartphone brand had dropped a few spots in the placing this quarter as the brand had only shipped out 13 million units this quarter, accounting for 18.1% of the Chinese smartphone market. Its lacklustre performance is further shown by its negative growth rate of -42.2%, the company’s lowest growth rate yet. The reason behind the brand’s decline may be due to stiff competition in the Chinese smartphone market in Q1 2022, and the team at Vivo should put out more competitive offerings if it wants to reverse its negative growth trend.

Apple

When compared to the strong sales of Q3 and Q4 2021, Q1 2022 was a rather dull quarter for Apple, as the brand shipped out 11.2 million units of iPhones in Q1 2022, accounting for 15.6% of the Chinese smartphone market, and experienced a negative YoY growth rate of -1.8%. The lower shipments could be contributed to the fact that Apple had many of its retail stores closed in China amid the COVID outbreak in the country, and coupled with economic uncertainties, people could still be holding onto phones for longer.

Xiaomi

Despite the early release of the Xiaomi 12 series in China, the Xiaomi brand had a rather uneventful Q1 2022 in terms of sales. The brand had shipped 11 million units of smartphones this quarter, accounting for 15.3% of the smartphone market in China, and with the current overall China smartphone market decline in Q1 2022, the brand had experienced a negative YoY growth rate of -20.3% in this quarter.

RELATED: