As one of the world’s largest smartphone markets, China with its population of over 1 billion reflects several of the future trends that we may see in the smartphone industry, with one of them being the brand of the SoC (System on a Chip) used in our smartphones.

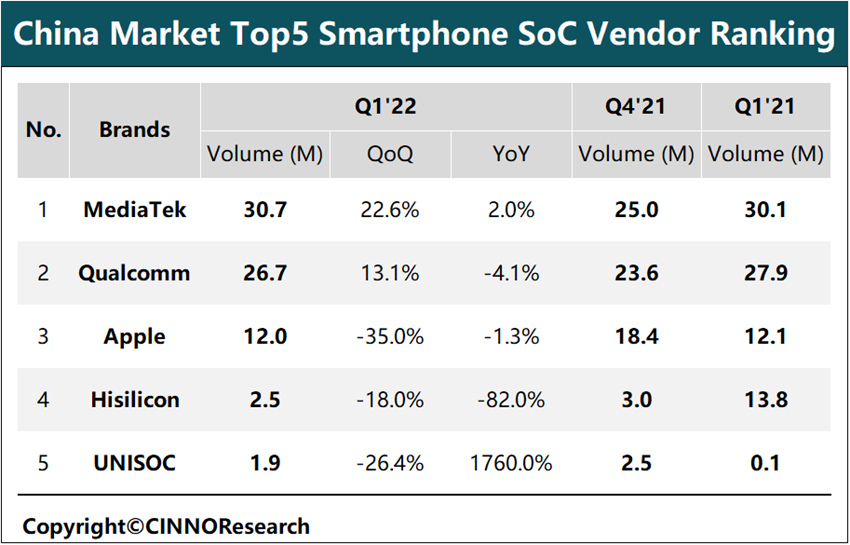

As we are almost halfway into 2022, data analytics firm, CINNO Research, has recently published a report on the Top 5 Smartphone SoC Vendors in the China market for Q1 2022, and it seems that MediaTek is the popular SoC brand used in smartphones for the quarter.

According to the report (via ITHome), smartphone SoC shipments in Q1 2022 were 74.39 million units, down 14.4% year-on-year, and down 0.7% quarter-on-quarter. And the top 5 vendors for the smartphone SoC vendors are MediaTek in the first place, Qualcomm in second, Apple in third, with Huawei’s HiSilicon and UNISOC in fourth and fifth respectively.

Let’s start from top to bottom, MediaTek saw 30.7 million smartphone chipsets shipped out in Q1 2022, which was higher than its 25 million shipments from last quarter, and 30.1 million shipments from Q1 2022. The rise in smartphone SoC shipments MediaTek can be mainly attributed to the semiconductor firm’s strategy and chipset catalogue that it had offered in the last 6 months, which included the brand’s popular Dimensity 920 5G chipset found on the Redmi Note 11 Pro+, Realme 9 Pro+ and Xiaomi 11i Hypercharge.

For Qualcomm, the brand remained relatively stable at second with 26.7 million smartphone SoC shipments in Q1 2022, higher than the 23.6 million figure from last quarter, but lower than the 27.9 million shipments from Q1 of last year. Coupled with the ongoing chip shortage, Qualcomm had earlier announced that it will gradually shift its focus to flagship chipsets instead of entry-level and mid-range chipsets due to flagship chipsets providing higher profit margins. However, the one caveat of this strategy is losing market share in mid-range and entry-level markets, which leads to lower shipments overall but higher revenues for the company.

Apple on the other hand, had only shipped 12 million smartphone SoCs in Q1 2022, down 15.8% from its 18.4 million figure from Q4 2021. As the iPhone nears the end of its release cycle, shipments are also expected to go down as well, because consumers are already expecting a new iPhone release soon, and therefore would hold off buying the current model and wait for the next iteration instead.

Huawei’s HiSilicon continues its gradual exit from the China smartphone SoC market as the firm had only shipped out 2.5 million units this quarter, down from 13.8 million in Q1 2021. As stocks for HiSilicon Kirin are not replenished due to the still ongoing supply sanctions against the company, the brand is expected to drop out of the top 5 as late as next year or as soon as the next quarter.

![]()

Squeezing just into the Top 5 is the rapidly growing UNISOC semiconductor company. UNISOC saw shipments of 1.9 million smartphones SoCs in Q1 2022, up 1760% from 0.1 million in Q1 2021. The main cause for the exponential growth behind UNISOC is the entry-level smartphone market. As the bigger players like Qualcomm and Apple’s main focus area is in the high-end, UNISOC aims to tackle the low end with its relatively much more affordable chipsets sold off to Realme, Motorola and Samsung to sell in their sub 100 dollar device market.

RELATED:

- Vivo X80 Series Launched Globally: First Dimensity 9000 and Sony IMX866 Flagship in the Global Market

- Realme GT Neo3 launched in India with Dimensity 8100, 150W / 80W charging

- Redmi K50 vs Realme GT Neo3: Specs Comparison

- Redmi K50 Standard Review: Dimensity 8100 — probably the Best Chip of the year

(Via)