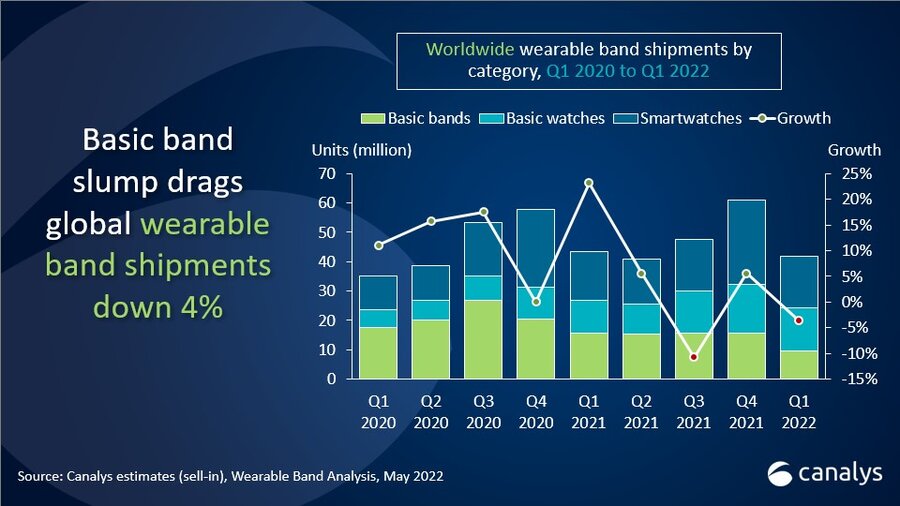

Leading global technology market analyst firm, Canalys has recently published a report on the state of the global wearables market in the first quarter of 2022. In the report, it is stated that 41.7 million wearables were shipped in Q1 2022 alone, of which basic fitness band shipments compromised of only 9.7 million (23.3 per cent of the market), while the rest of the market is held by basic watch and smartwatch shipments at a staggering 32.0 million.

Overall the worldwide wearables market in Q1 2022 experienced total shipments fell by 4% YoY when compared to Q1 2021. This phenomenon is caused by the rapidly declining social relevance of fitness bands, but fortunately, shipments did not fall further due to the rising popularity of the basic watch and smartwatch market.

Currently, Apple, Huawei and Xiaomi are the Top 3 best-selling wearables brands globally. Apple dominates in first with its 22.1% market share. The company had shipped out 9.2 million of its Apple Watches in Q1 2022, which could be could be contributed to the brand launching not only its flagship Apple Watch Series 7 of smartwatches but also launching a more affordable Apple Watch SE smartwatch, providing more options for the consumers and capturing more of the market share. Due to this, the company experienced a positive 21% growth in annual sales when comparing Q1 2021 and Q1 2022.

Moving onto Huawei, the company rises up from third place last year to second place this year with 11.1% of the wearables market share and 4.1 million total shipments of its fitness bands and smartwatches. The brand remains steady in the wearables market with the main appeal of its smartwatches being the company’s OpenHarmony ecosystem. The OpenHarmony ecosystem allows Huawei smartwatches to not only be connected to your Huawei smartphone, but also to Huawei’s IoT smart devices as well. And that includes the company’s own electric vehicles. For example, you can use your Huawei Watch as digital car keys to unlock your Huawei Car.

Xiaomi, on the other hand, has dropped from second to third with 10.1% of market share and 4.2 million shipments, mainly due to dwindling sales of the brand’s fitness bands. As fitness bands continue to lose in popularity due to their smaller screens, the brand itself is already quietly switching its focus to developing smartwatches. But currently, Xiaomi smartwatches like the Xiaomi Watch S1 are still the company’s first attempts at the concept, and with the shifting marketing focus, the fitness band sales decline is to be accelerated as well.

Coming in at 4th and 5th are Samsung and Fitbit respectively. Samsung remains stable in the wearables market with an increased 8.1% market share in Q1 2022 at 3.4 million shipments, due to the company’s collaboration with Google’s Wear OS for its Samsung Galaxy Watch 4 series of smartwatches. Meanwhile, Fitbit, which has been acquired by Google saw its sales drop to 2.9 million in Q1 2022 with 7% of the total wearables market share.

Analysing the basic fitness band market, it has been on a steady decline since Q4 2020. The bands suffered a 37% decline quarter-on-quarter (Q4 2021 to Q1 2022), marking the sixth consecutive fall in the quarterly shipments since Q4 2020. And the 9.7 million shipments figure is the first time that the fitness band market has dipped below 10 million in a long time after it had peaked at 27.9 million in Q4 2019.

On the other hand, the basic watch and smartwatch market has seen positive growth YoY by up to 15%. The Canalys report has cited some reasons why watches are growing in popularity.

“Consumers are favouring watches over bands. With bigger displays, richer features and longer battery life, they believe watches are better able to fulfil their health-tracking and digital lifestyle needs,” said Sherry Jin, Canalys Research Analyst. “Basic watches are positioned as an affordable step-up from basic bands, suitable for price-conscious consumers with growing expectations as to what wearables can do.”

RELATED:

- Xiaomi Mi Band 7 NFC Smart wearable Review: Still one of the best entry-level wearables

- Xiaomi 12 Ultra to arrive in premium materials such as leather and ceramic, says tipster

- Redmi Note 11T Pro flaunts one of the best LCD screens in its segment — Here’s Why

- Apple Watch Series 8 renders leak online showcasing the design of the smartwatch

(Source)