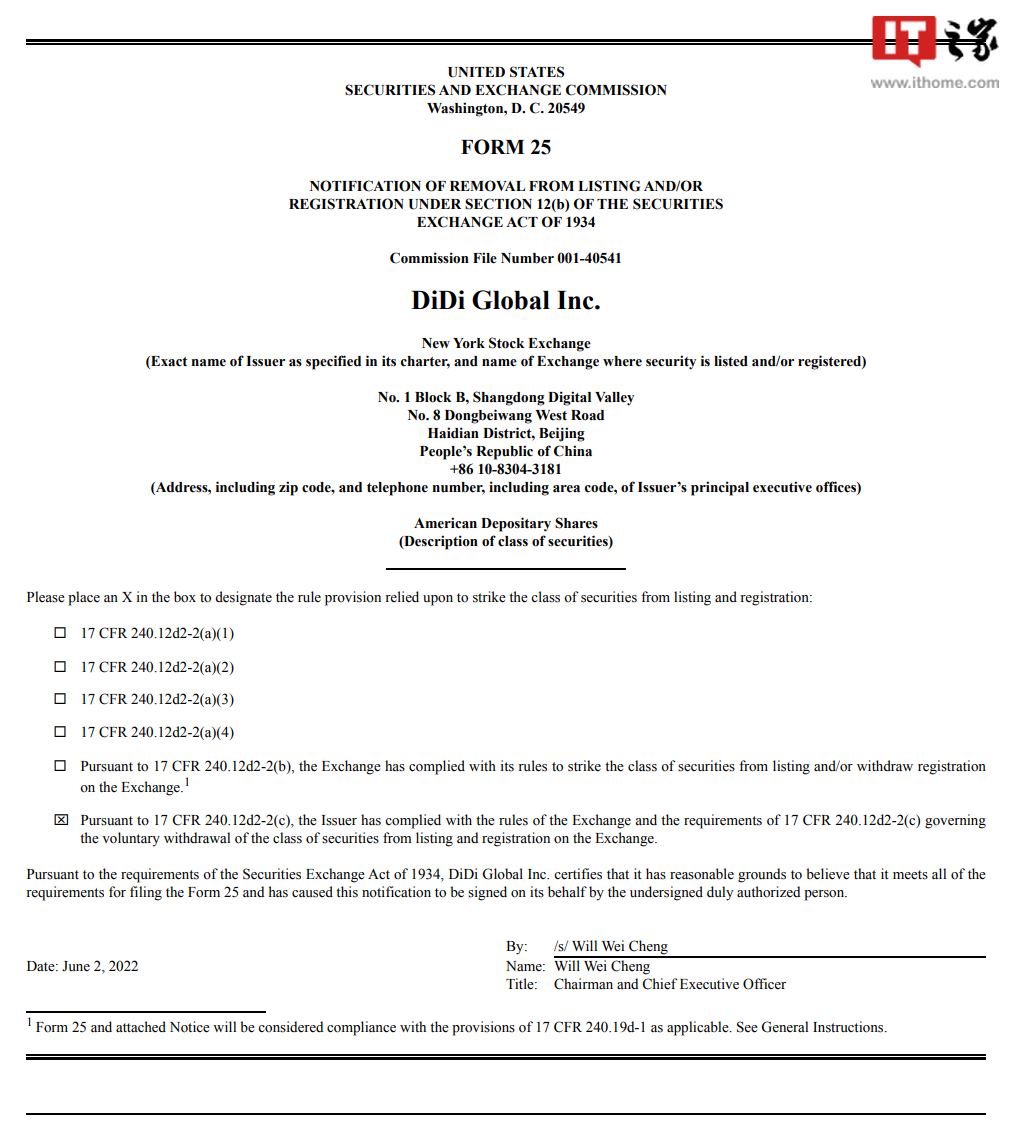

Chinese ride-hailing service giant, DiDi Global, has officially submitted its application for delisting from the New York Stock Exchange (NYSE) on June 2nd, ITHome (Chinese news site) reports. According to standard operating procedures, the application will be approved and the delisting will take effect immediately after 10 days the application has been submitted.

The company formally filed its Form 25 with the U.S. Securities and Exchange Commission on June 2nd to delist its American Depositary Shares.

Earlier on May 23rd 2022, DiDi Global held its extraordinary general meeting (EGM) to decide whether the company should delist from the NYSE amid growing concerns from both external and internal parties. The conclusion was that 96.26% of shareholders who were present and voting, voted in favour of delisting DiDi‘s American Depositary Shares from the NYSE, the company said.

Of the 1.2 billion shares outstanding as of April 28 this year, members holding roughly 811.44 million shares cast their votes in the EGM.

Reuters reported that DiDi has struggled to bring its business back to normal after angering Chinese regulators by pushing ahead with its $4.4 billion New York listing in June last year despite being asked to put it on hold.

Days after DiDi went public on the NYSE, China’s powerful internet watchdog Cyberspace Administration of China (CAC) launched a cybersecurity probe into the company’s data practices and ordered app stores to remove 25 mobile apps operated by DiDi.

“It’s the only option for shareholders. They were going to be in purgatory if they (DiDi) persisted in their disobedience to the Chinese government,” reported Reuters, quoting Thomas Hayes, chairman of Green Hill Capital.

RELATED:

- Didi seeks to raise $6 billion for its self driving unit: Report

- Xiaomi partners with Leica to develop a flagship smartphone launching in July

- Redmi Note 11T Pro flaunts one of the best LCD screens in its segment — Here’s Why

- Redmi Note 11T Pro first sale: 270,000 units sold in one hour

- You can now pre-order Redmi Note 11T Pro for $339 at Giztop