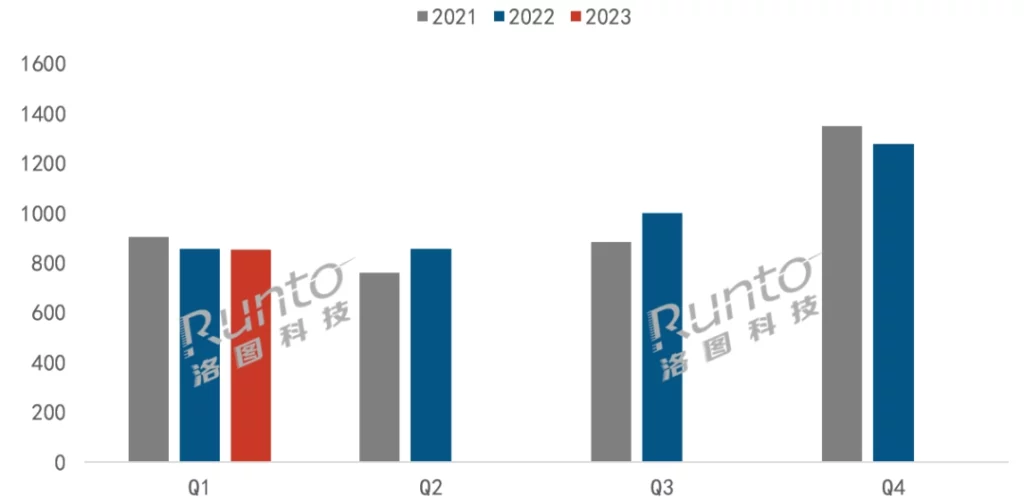

The first quarter of 2023 has proven to be a mixed bag for the Chinese TV market, with some brands maintaining their lead and others experiencing significant declines. According to recent data from RUNTO, the total shipment volume of Chinese TV brands reached 8.52 million units in Q1, a minor 0.6% decrease compared to the same period in 2022, and an 8.9% drop compared to 2021. Here are the details…

Xiaomi Retains Dominance in Q1 2023 Chinese TV Market, TCL Soars, and Huawei Struggles

In Q1 2023, the combined shipment volume of the top seven traditional Chinese TV brands—Xiaomi, Hisense, TCL, Skyworth, Changhong, Haier, and Konka—along with their sub-brands reached 7.89 million units, representing a 2.5% YoY growth. These brands captured a massive 92.6% of the total market share, a historical high, and a 2.7 percentage point increase from the same period in 2022. Breaking down the performance of each brand:

- Xiaomi, including its Redmi sub-brand, shipped approximately 2 million units in Q1, accounting for 24% of the overall market share. Despite a slight decrease compared to 2022, Xiaomi maintained its top position in the Chinese TV market for the fourth consecutive year.

- Hisense, along with its Vidda sub-brand, shipped nearly 2 million units, achieving a 13% YoY growth and a market share increase of around 3 percentage points. Notably, the Hisense brand led the market in monthly shipments during February and March.

- TCL, featuring sub-brands Leiniao and Lehua, witnessed a 37% YoY growth in Q1, the highest growth rate in the industry. Its market share also increased by 4.5 percentage points compared to the same period last year.

- Skyworth, accompanied by its Coocaa sub-brand, saw a considerable 11% growth in Q1, along with a 1.5 percentage point increase in market share.

- The second-tier brands Changhong, Haier, and Konka, which typically have an annual shipment scale of around 3 million units, experienced a challenging Q1. They faced intense competition from top-tier brands, resulting in decreased shipment volumes and combined market shares. Their total shipments amounted to roughly 1.3 million units, with a YoY decline of over 20% and a market share reduction of around 5 percentage points.

- Huawei struggled significantly in Q1 2023, as internal adjustments negatively impacted sales. Shipments fell below 200,000 units, marking a YoY drop of over 50%.

- Sharp, a foreign brand, faced a similar decline as Huawei, with its shipment volumes cut in half. Other brands like Sony, Samsung, and Philips maintained their 2022 market shares, with a combined share of less than 10%.

As we move further into 2023, the industry will closely monitor the TV market’s performance during the short holiday in early May and the 618 presale event at the end of May. These events will likely provide crucial insights into the market dynamics and future trends for the remainder of the year.

RELATED:

- Honor Magic5 Pro vs Huawei P60 Pro: Specs Comparison

- TCL 2023 C64 QLED 4K TVs with super-slim, bezel-less design Launched in Europe

- Redmi Note 12 Turbo & Redmi Buds 4 Harry Potter Special Edition Unboxing

- TCL Q10G Pro with up to 98-inch display & X11G Mini LED TVs Launched…

- Realme GT Neo5 SE Shatters Sales Records: Over 100,000 Units Sold…

(source)