US sanctions on semiconductor exports to China have minimal effect on the industry as companies are creating different variants of microchips, especially for the Chinese market.

As part of a deliberate effort to stifle China’s domestic semiconductor industry, the US has been gradually limiting the access of Chinese companies to advanced chipmaking technologies. The sanctions bar US companies like Nvidia Corp and Advanced Micro Devices Inc from exporting the latest chips to China.

However, Nvidia Corp and other technology giants facing strict US sanctions have managed to overcome the restrictions by producing customized versions of their chips exclusively for the Chinese market.

According to a Reuters report, these chips are not cutting-edge and may take 10% to 30% longer to perform certain AI tasks, potentially doubling the costs compared to Nvidia’s top-performing chips in the US. Despite the reduced speed of Nvidia’s chips designed for the Chinese market, they still provide a significant upgrade for Chinese companies.

Nvidia is currently providing its H800 chips to some of the biggest technology companies in China, such as Tencent, Alibaba Group Holding Ltd, and Baidu Inc, for their use. Nvidia has stated that the U.S. government’s intention is not to damage competition or American industry and that U.S. firms are permitted to offer products for commercial purposes, such as providing cloud services to consumers.

What are the major US Sanctions?

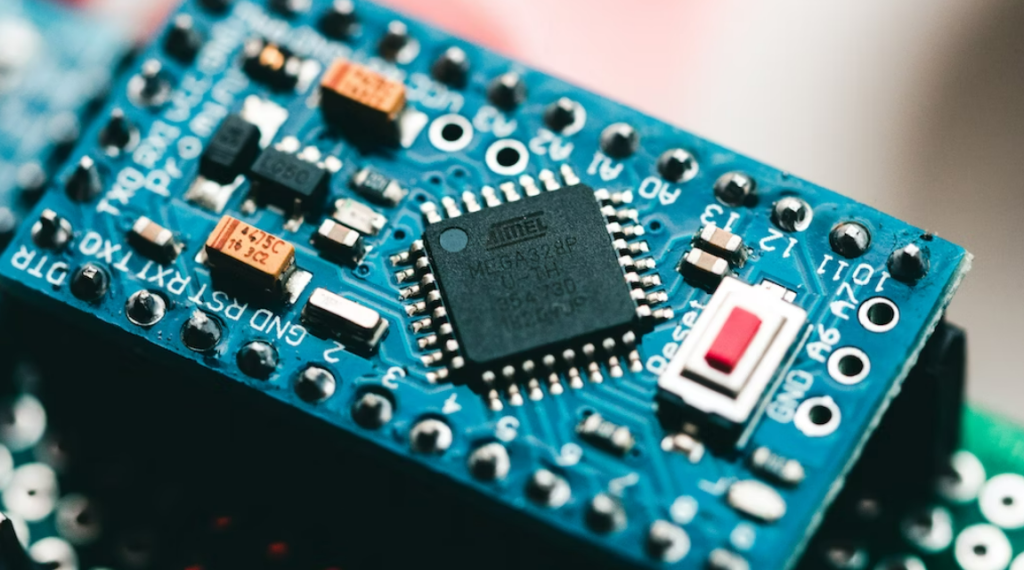

The US has implemented two types of sanctions on semiconductors. Firstly, they have imposed a limit on a chip’s ability to perform exceptionally accurate calculations, with the intention of curbing the creation of military-focused supercomputers. Secondly, there is a constraint on chip-to-chip transfer speeds, which has an impact on artificial intelligence. For instance, technologies like ChatGPT rely on models that are too vast to be contained on a single chip, necessitating distribution across thousands of chips that need to intercommunicate.

The US announced controls on technologies for making advanced chips, including 14-nanometer, 16-nanometer, and even shorter-length chips, in an effort to limit China’s progress in fields such as artificial intelligence, quantum computing, and ballistic missile development. Despite these efforts, there are indications that China may have already made significant strides in producing chips smaller than 14 nm. For instance, Semiconductor Manufacturing International Corp. (SMIC), China’s biggest contract chip manufacturer, claimed to have successfully produced 7 nm chips last year, though questions remain about the sustainability of this production.

China’s Semiconductor Industry

China’s current semiconductor capabilities are not on par with those of countries like Taiwan, the Netherlands, or the US. However, since the launch of the Made in China 2025 initiative Chinese companies have made progress in different aspects of the semiconductor industry

China’s semiconductor industry comprises a diverse range of companies, including fabless semiconductor firms such as ZhaoXin, UNISOC, and HiSilicon, as well as integrated device manufacturers like Yangtze Memory Technology Corp and ChangXin Memory Technologies.

With almost one-third of the global sales, China currently holds the position of the world’s largest semiconductor market. The semiconductor industry is a significant contributor to China’s technology sector, which comprises around 30% of its GDP.

According to Cade Daniel, a software engineer at San Francisco-based start-up Anyscale, the industry had anticipated that AI models would continue to grow in size two years ago. If that were still the case, the current export restrictions would have had a much greater effect. However today, while the restrictions are noticeable, they are not as catastrophic as they could have been.

Moreover, the process of chipmaking involves the synchronization of numerous disparate resources and sophisticated technologies, including raw silicon ingots, rare earth metals, and more which cannot be easily achieved by any country.

However, China has a three-decade headstart in developing its collection of skilled chip engineers, rare earth metals, and numerous domestic suppliers. Thus despite being behind the global leaders in semiconductor technology, China has the ability to bounce back from the restrictions and compete with global leaders in the near future.

Related:

- Huawei Chairman says the US sanctions will benefit China’s chip industry

- China’s Strategic Advancements in the Trade War with the US: YMTC’s Aim for Self-Sufficiency in Semiconductor

- A New 5G Huawei Smartphone may be Under Testing

(via)