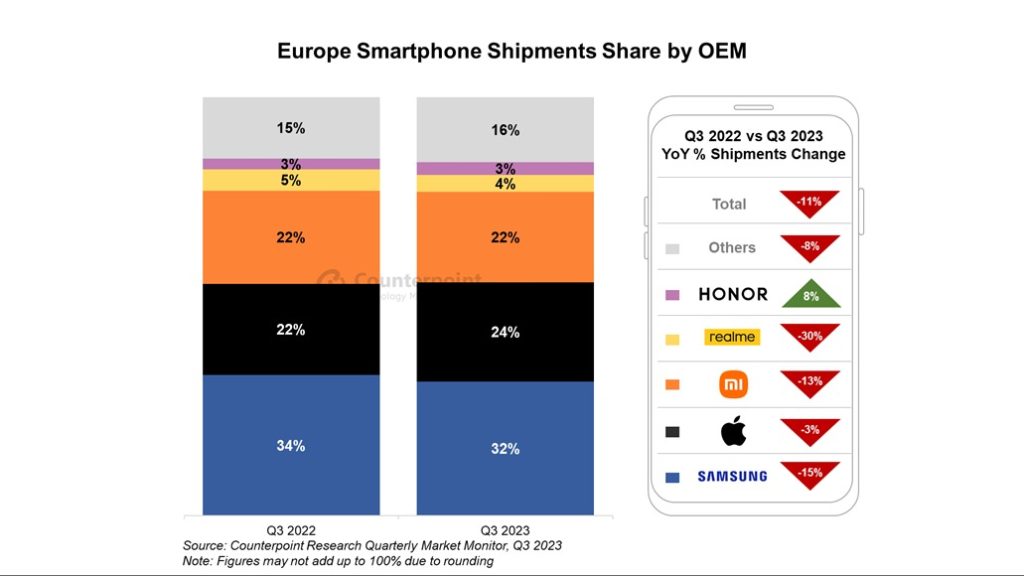

Like the global smartphone shipment trends, Europe also registered a decline in shipments in the quarter that ended on 30th September 2023. According to a new Counterpoint Research report for Market Monitor Service, smartphone shipments declined 11% YoY in Q3 2023. Major OEMs like Samsung and Apple recorded their worst quarter after 2011 and 2014, respectively.

Must See: TWS Shipments In India Record A Whopping 85 Percent YoY Growth In 2022: Counterpoint Research

As per the report, the demand in the Western European market declined by 8%, and Eastern Europe further dipped by 15%. The ongoing economic and geopolitical challenges in the region are the primary reasons behind sluggish sales.

Amid the decline, Samsung maintained its primary position with 32% market share, Apple preceded with 24%, while Realme raked 22% market share. Honor evolved by 8% from the previous year with a 4% market share.

Speaking on the statistics, Research Analyst Harshit Rastogi said, “Q3 2023 saw the lowest Q3 smartphone shipments since 2011. However, some OEMs have managed to gain a foothold in the market, such as Transsion brands TECNO and Infinix (particularly in Russia), while HONOR is doing well in Western Europe. Even as the market shares of top players remain the same, Chinese OEMs are switching ranks among themselves.”

Samsung retained its position with good demand for its foldable in the region; meanwhile, Apple will rake up some sales this quarter with the iPhone 15 series. Xiaomi is facing backlash from some Western European countries due to its presence in the Russian market. It’s market share declined by 13%. Oppo is also losing ground in the European region due to some issues. Surprisingly, Honor, TECNO, and Infinix registered exceptional growth in comparison with the previous year.

Commenting on the new statistics, Associate Director Jan Stryjak said, “While the market continued to decline, major launches like the iPhone 15 series and Samsung’s fifth-generation foldables softened the fall. The rate of decline is slowing and, while we aren’t holding out a return to growth just yet, we are optimistic about a strong end to the year in Q4. Economic conditions continue to be tough, though, and people are holding on to their devices for longer than ever. Therefore, we expect the market to remain muted for the foreseeable future.“

The future growth prospect seems a dream for some unforeseen future in the European smartphone market.

Related:

- Apple and Samsung Lead Global Smartphone Sales in Q2 2023, Reveals Counterpoint Research Report

- Chinese researchers uncover security flaws in AI models, including ChatGPT

- China is Setting Ethical Boundaries on Scientific Research from December 1

- We Don’t Need Chargers in the Box: Researchers Develop Long-Distance Wireless Charging with 80% Efficiency

- Huawei’s Plans for £1 Billion Cambridge Research Campus Hit Dead End