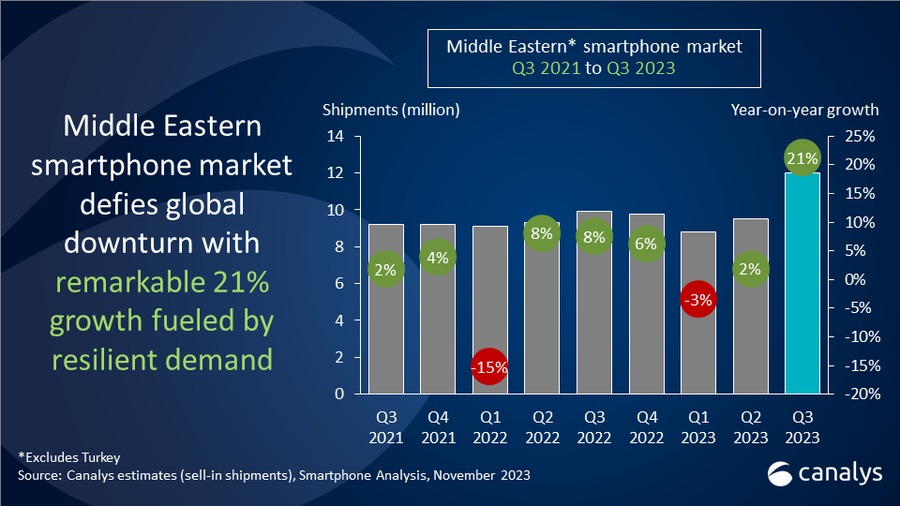

This year, there has been a decline in the number of smartphones shipped around the world. Sales of smartphones have been falling in every major market, including those in North America, Europe, and Southeast Asia. Following the ongoing festive sales, there’s a slight chance of improvement, but the overall year remained sluggish for global shipments. Surprisingly, the Middle Eastern smartphone market defied the global smartphone market signals and registered a 21% annual growth in Q3 2023.

Must See: Global smartphone market shows signs of recovery in 2024: Canalys

Middle-East Smartphone Shipments Details

As per a new Canalys research report, smartphone shipments in Middle Eastern countries (excluding Turkey) have registered a significant growth of 21%, with 12.0 million shipments. An increase in business growth due to local demand is one of the primary reasons behind the growth. Job and business opportunities have exceptionally increased in recent times, unaffected by falling oil prices.

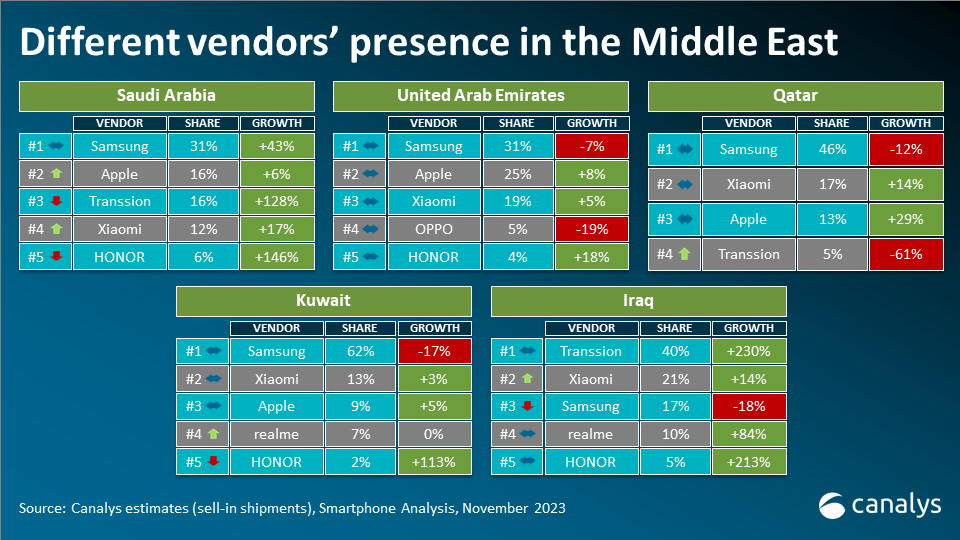

The markets in Iraq and Saudi Arabia soared to historical highs, with 57% and 46% growth on a year-over-year basis, respectively. Surprisingly, despite some limitations and challenges while importing in US dollars, Iraq gained maximum growth. Meanwhile, the United Arab Emirates market registers only a 2% increase in shipments which is mostly fueled by increased tourist footfall. Qatar and Kuwait show a slight decline due to subdued demand in both countries.

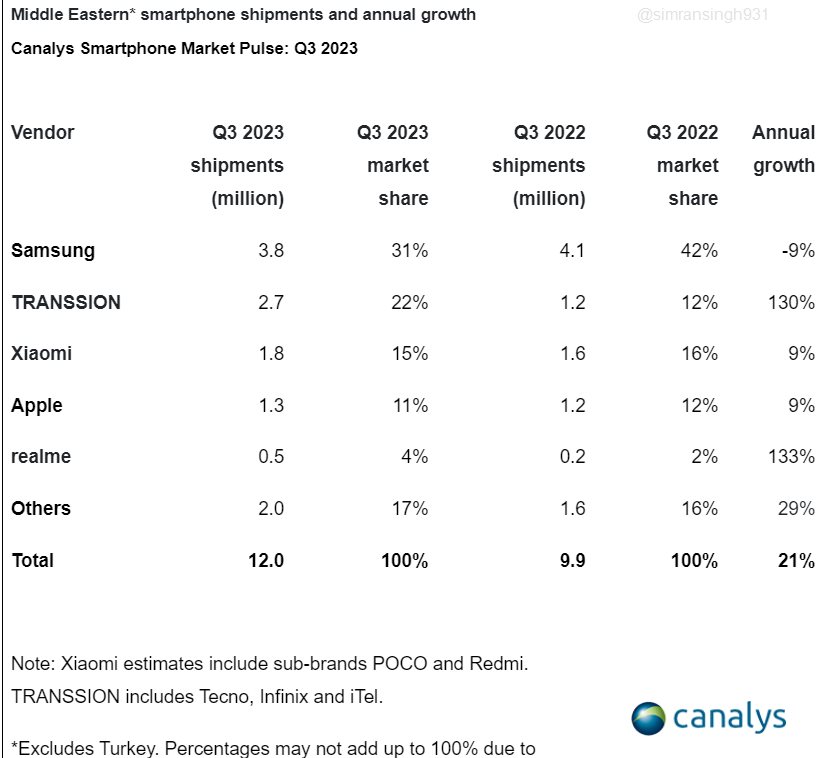

Samsung accounts for 31% of the total smartphone shipments in Q3 2023. It is followed by Transsion with 22% share, Xiaomi with 15% share, Apple with 11% share, and Realme in 5th position with a mere 4% share.

Inclination towards Budget Smartphones in Middle-East

Unlike Southeast Asian markets, the Middle East is more inclined towards budget smartphones which translates to under $200 market. The maximum sales are garnered by Chinese brands such as Xiaomi, Transsion, and Honor.

“TRANSSION is steadily increasing its footprint in response to the expanding mass-market segment amid broader economic uncertainties. Infinix introduced exclusive models with Noon in Saudi Arabia, while Tecno promoted its Camon 20 with enhanced incentives in Iraq. While Xiaomi and HONOR strive to penetrate the premium market with enticing incentives and aggressive promotions, luring customers away from established brands demands persistent investment,” reveals Manish Pravinkumar, Dubai-based Senior Consultant at Canalys.

Motorola further increases its growth in the enterprise businesses in the GCC region. However, Samsung and Apple remained at their respective positions with their extensive distribution network and ecosystem strategy, respectively.

Further, emerging brands are working on their marketing campaigns to garner sales. While Oppo and Honor are bringing foldable to the market to compete against Samsung’s prowess. However, “consumers in markets such as Qatar, Kuwait and Saudi Arabia will still hesitate to switch brands. Affordability, aspirational value and availability will be pivotal factors for emerging players, with schemes such as Buy Now Pay Later gaining traction through platforms such as Tabby and Tamara, proving beneficial for both retailers and consumers, “said Pravinkumar.

Related:

- Samsung Sets Ambitious Target of 250 Million Smartphone Shipments in 2024

- Redmi Note 12 5G is the fastest Android phone to surpass 1 Million shipments in 2023

- Global PC shipments decline for eighth straight quarter, says Gartner

- Apple Wipes Out Android in Global Smartphone Shipments; iPhone 14 Pro Max is the Most Popular Smartphone in the World