As Chinese smartphone OEMs have now more or less completely dominated the budget segment, the mid to high-end segment is increasingly becoming more important. Not only is the range just another bit waiting to be conquered, but higher-value phones are also more profitable.

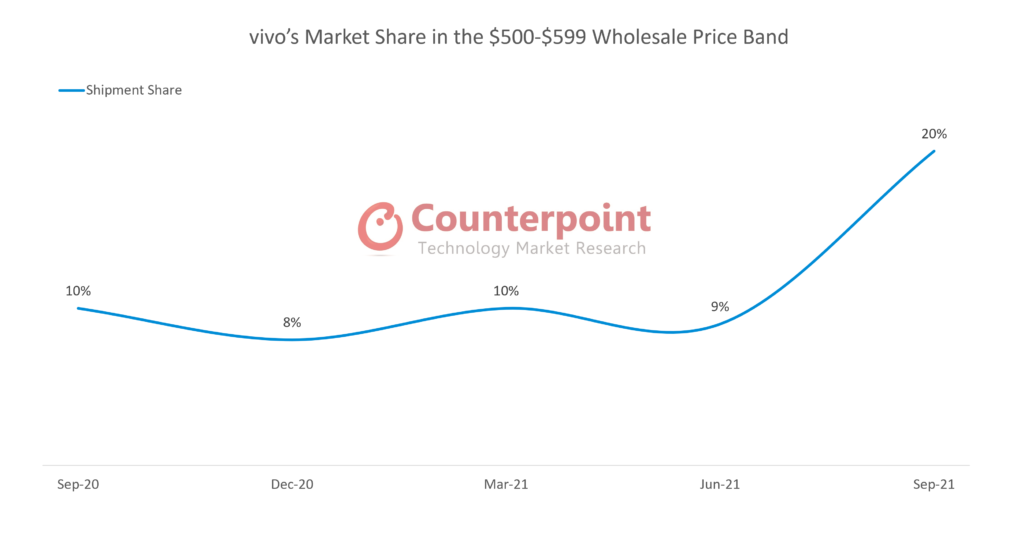

The true champ in the entry-premium, however, has been vivo which has made quite the progress in China’s mid to high-end segment (via Counterpoint Research). The company’s market share in the $500-$599 range (at wholesale price) has risen from 10% to 20% in just a year from September 2020 to September 2021. The price band used to be dominated by Huawei.

Much of this was driven by none other than vivo’s flagship X70 Pro offering, and of course, the company’s strides in innovation in camera tech. vivo recently also partnered with optical technology leader ZEISS.

The vivo X series wasn’t always a solely premium offering though. It earlier had blurring boundaries – something that was addressed with the launch of the S series in April 2021, effectively freeing it from the $470 and below segment.

Moving on to China’s smartphone market itself, Counterpoint Research expects it to see flattish growth this year, with a lot of it having to do with the semiconductor shortage. The slow market size growth rate is leading OEMs to move into the game of revenue and average selling price (ASP).

The research firm further says that Chinese OEMs are no longer pleased to be crowned as the “king of affordable” and are hungry to grab more of the $470 and above segment. The price bracket is increasingly becoming a strategic territory for all Chinese OEMs and competition in it is expected to rise next year.

RELATED:

- vivo announces OriginOS Ocean with a colorful UI, better shortcuts, & new features

- OriginOS Ocean update timeline for vivo, iQOO devices is here

- vivo Y55s goes official, features biggest battery in a vivo phone yet

- Upcoming vivo S12 phones codenamed ‘Superman’ may usher in new era for S series

- Mysterious Vivo V2140A TENAA certified, specifications, images emerge