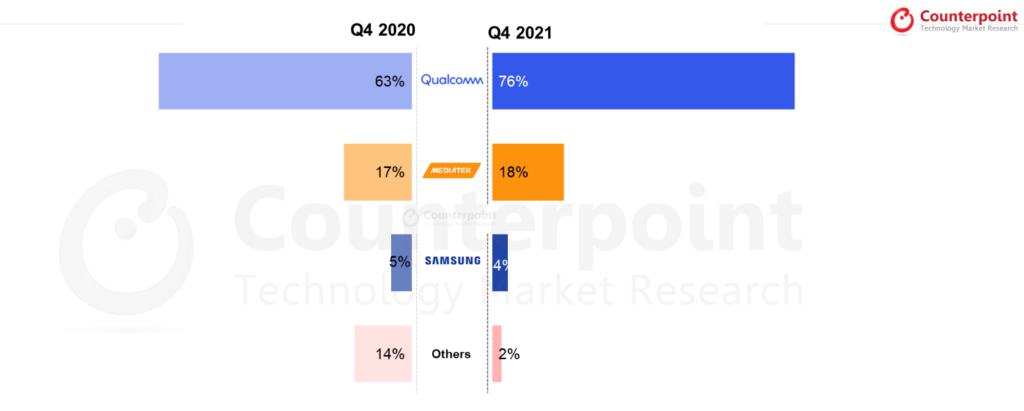

While MediaTek maintained its lead, Qualcomm recorded 33% YoY growth in the global smartphone AP (Application Processor) / SoC (System on Chip) market in 2021. The market grew 5% YoY in Q4 2021 overall, with almost half of the SoC shipments being 5G smartphone SoC shipments, the latest Counterpoint figures show.

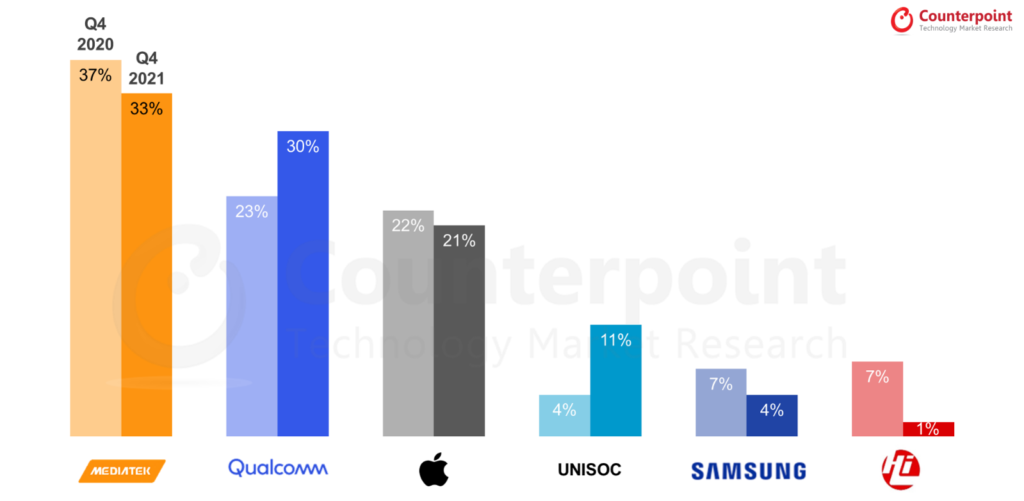

MediaTek led the smartphone SoC market in Q4 2021 with a 33% share. But its shipments declined due to inventory correction. Still, the company is expected to see growth in its revenues in the first quarter of 2022 driven by the Dimensity 9000 chipset. Lower seasonal demand will be offset by higher 5G penetration.

Meanwhile, Qualcomm recorded a strong quarter, growing 18% QoQ in the fourth quarter of last year despite component shortages and inadequate foundry capacities. The chipmaker was also able to prioritize high-end Snapdragon processor sales, which come with higher profitability. It was also able to increase supplies from its major foundry partners by dual-sourcing orders.

Apple stood third in the smartphone SoC market in the fourth quarter of 2021 with a 21% share, with shipments driven by iPhone 13 launch and festive season demand.

UNISOC recorded growth this year and reached an 11% share in Q4 2021, with shipments more than doubling in 2021. It has expanded its customer base and currently supplies to companies like HONOR, realme, Motorola, ZTE, Transsion, and Samsung.

Samsung dropped to fifth place while Hilisilicon saw its market share drop to just 1% as its inventory of Kirin SoCs ran out.

RELATED:

- Samsung reportedly loses business to manufacture Qualcomm Snapdragon chips

- Qualcomm Snapdragon 5100 series chipsets to be manufactured using 4nm process

- Xiaomi 12 Ultra to carry the TSMC Qualcomm 4nm Snapdragon 8 Gen 1+, based on insider reports

- Qualcomm pushes for Snapdragon 8 Gen1+ launch to replace Samsung made 8 Gen1 chips: Report

- Qualcomm announces world’s first demo of iSIM tech that integrates SIM card with processor