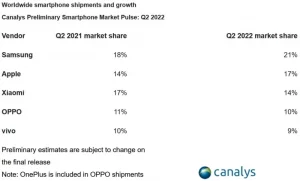

Samsung maintained its position as the leading smartphone provider globally with a 21 percent market share. Thanks in part to strong sales of its reasonably priced Galaxy A series.

Data from market research company Canalys’ second-quarter sales figures reveal a 9 percent decrease in smartphone shipments year over year. The descriptive analysis of the reasons for the problem blames both regional and worldwide economic difficulties.

Apple was able to maintain the second best market share among all phone manufacturers with 17 percent thanks to the continued high demand for the iPhone 13 series. Xiaomi, Oppo, and Vivo, all Chinese brands, came in third, fourth, and fifth, respectively. The second quarter saw reductions in phone shipments for each of these companies, leaving them with respective market shares of 14% (Xiaomi), 10% (Oppo), and 9% of the global market (Vivo).

Apple was able to maintain the second best market share among all phone manufacturers with 17 percent thanks to the continued high demand for the iPhone 13 series. Xiaomi, Oppo, and Vivo, all Chinese brands, came in third, fourth, and fifth, respectively. The second quarter saw reductions in phone shipments for each of these companies, leaving them with respective market shares of 14% (Xiaomi), 10% (Oppo), and 9% of the global market (Vivo).

Runar Bjrhovde, a Canalys Research Analyst, said: “Vendors were forced to review their tactics in Q2 as the outlook for the smartphone market became more cautious. Economic headwinds, sluggish demand, and inventory pileup have resulted in vendors rapidly reassessing their portfolio strategies for the rest of 2022. The oversupplied mid-range is an exposed segment for vendors to focus on adjusting new launches, as budget-constrained consumers shift their device purchases toward the lower end.”

For the record, Apple’s market share increased by a commanding 21.4 percent on a yearly basis. With a 16.7% year-over-year rise in Q2 market share, Samsung came in second place to Apple. Vivo lost 10% of its Q2 2021 market share in 2022, while Oppo had a 9.1% annual decline in its second quarter market share. Xiaomi saw a loss of 17.6% of its Q2 2021 market share.

RELATED