A new report has revealed the shipments of mobile phone processors in the Chinese market for the month of September as well as the third quarter of 2021, with MediaTek seeing a strong performance in the region.

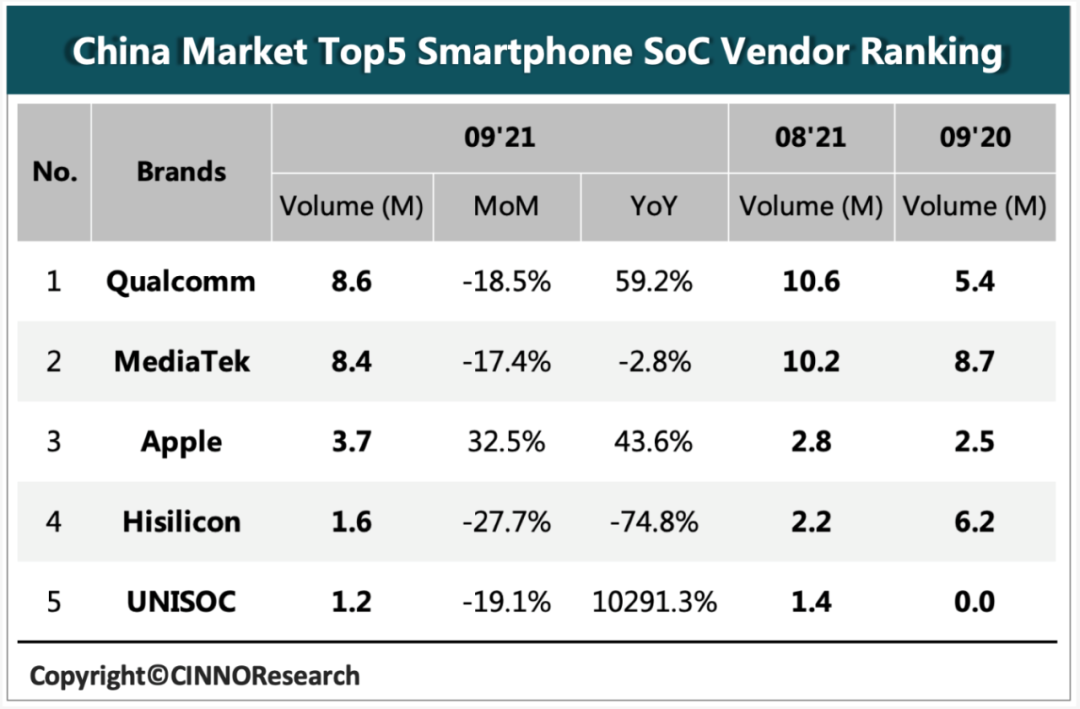

Top 5 Smartphone chipmakers in China – September 2021

According to a report by CINNO on total chip shipments in September 2021, Qualcomm came in at the top with 8.6 million units sold with an amazing increase of 59.2% compared to September of last year. The chipmaker was however down by 18.5% when compared to its sales of august. MediaTek saw lackluster results in September as their sales went down 17.5% compared to August and 2.8% in comparison with September 2020.

With its September release, Apple saw robust demand for the iPhone 13 series. This meant that its A-series chips also saw a rise, with shipments increasing by 32.5% quarter-on-quarter and 43.5% year-on-year. This major release has been attributed as the main factor in the decline of Android-based SoC sales in China for the month of September.

Huawei’s HiSilicon suffered a 27.7% decrease in its September sales compared to August and 74.8% in comparison with September 2020. UNISOC also experienced a decrease in its September sales numbers by 19.1% but soared an astounding 10291.3% in contrast to September 2020.

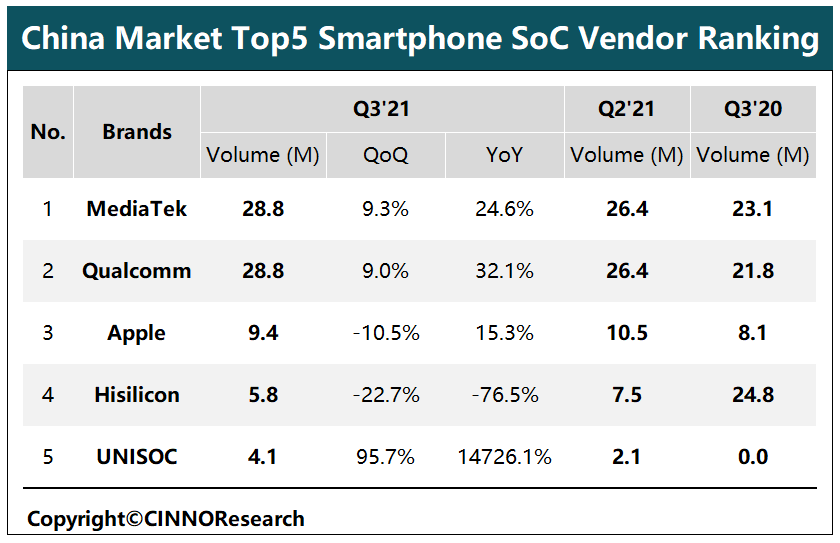

Top 5 Smartphone chipmakers in China – Q3 2021

The CINNO report also analyzed the performance of SoC makers for the third quarter of 2021 with MediaTek matching Qualcomm in sales volume with 28.8 million units shipped, showing a Quarterly Growth of 9.3% in Q3 2021 and a 24.6% growth compared to Q3 of last year. On the other hand, Qualcomm secured the second position with 9% quarterly growth in Q3 2021.

Apple shipments declined by 10.5% quarter-on-quarter with 9.4 million A-series chips shipped, but still showed a steady increase of 15% in shipments when compared to 2020. Huawei HiSilicon saw an overall drop in shipments in Q3, dropping by 22.5% (5.8 million shipped) compared to Q2 2021 (7.5 million shipped). The chipmaker saw a drop of a staggering 76.5% when compared to last year (24.8 million).

The report added that UNISOC witnessed an explosive 14726.1% growth year-on-year compared to Q3 of 2020. Now, the company holds the fifth position in the Chinese smartphone SoC market. UNISOC achieved a 96% growth in Q3 2021 compared to the second quarter, shipping around 4.1 million units. The company also managed to maintain robust sales with its major customers, which included Honor, Nokia, China Telecom, and more. It’s most popular SoC being the UNISOC Tiger T610 which powers the Honor Play 5T and Honor Play 20.

RELATED