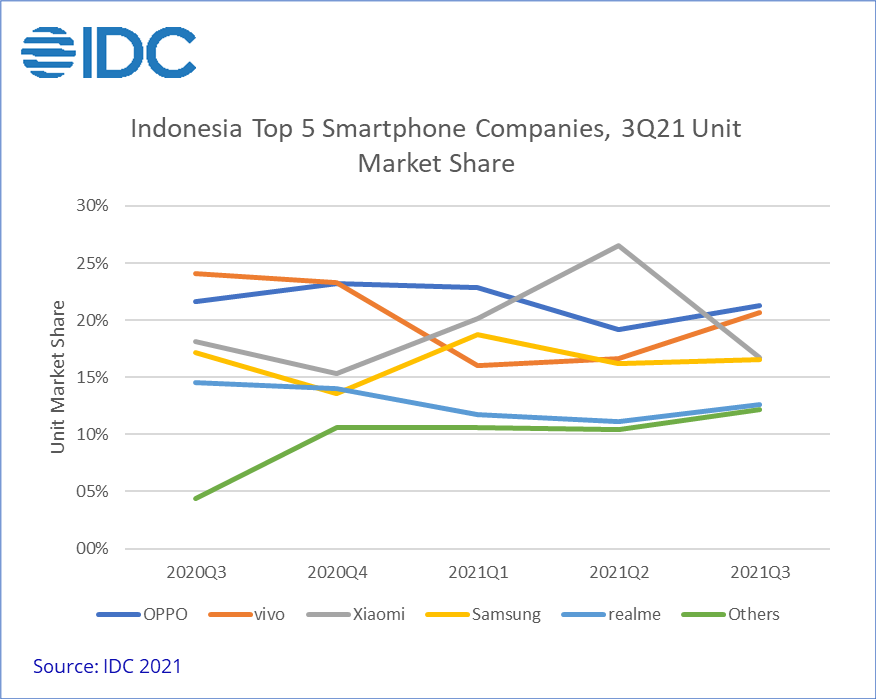

OPPO and vivo have taken the first and second spots, respectively, in an Indonesian smartphone market that saw a 12.4% YoY decline in shipments. The decline was due to supply constraints and Xiaomi seemed to have been hit the hardest, dipping to the third spot as a result.

The data concerns the third quarter of 2021 and comes from the latest IDC Quarterly Mobile Phone Tracker, also revealing that only 9.2 million units were shipped in the country in the quarter. The second wave of COVID-19 peaked in July 2021, which resulted in stricter lockdown regulations that lasted for a significant part of 3Q21, and in turn, affected offline sales.

While restrictions have begun to ease since September, supply shortages will continue to impact smartphone production and sales indefinitely. 4G smartphones will also be growing more scarce as OEMs focus more on their 5G offerings. With a dwindling supply, such smartphones will also be growing more expensive.

In 3Q21, more 5G models were released, bringing the total share of 5G to 7%, up from 6% in the previous quarter. As OEMs strive to bring affordable 5G smartphones to market, the average selling price (ASP) of 5G smartphones fell by 27% QoQ to $418 in 3Q21.

Moving on to the companies themselves, OPPO is now king of the hill as stated above, having kept a relatively steady inventory despite the supply shortages. It was still the leader in the low-end segment (US$ 100 < US$ 200), which accounted for the majority of its shipments. It is followed by vivo that managed to climb to the second spot thanks to its growth in offline sales. The company was also aided by its Y series in the low-end segment.

Things did not look too rosy for Xiaomi during Q3 2021 though as it dropped to the third position following two consecutive quarters of strong growth, facing significant constraints in terms of supply. Despite this, the company stood leader of the mid-range segment ($200 – $400).

Samsung stood fourth in the Indonesian smartphone market with a share almost equal to that of Xiaomi now, that is, a little above 15%. It is trailed by realme with a relatively flatter and more stable growth curve.

RELATED:

- Vivo, now the 3rd Most Popular Premium Smartphone manufacturer in China, surpasses 22% market share

- Samsung leads global smartphone market in Q3 2021: Report

- Nokia smartphone sales reached almost 3 million units in Q3 2021

- vivo X series helps company see tremendous growth in entry-premium smartphone segment

- OPPO Find X3 Pro gets ColorOS 12 stable update in Malaysia, Thailand, Indonesia