AnTuTu is a Chinese benchmarking tool used to record the performance of devices. AnTuTu also provides monthly reports on general data gathered from devices.

We will be providing a detailed coverage of what each category holds the most popular percentage last month and later lead towards what we will be expecting after this month.

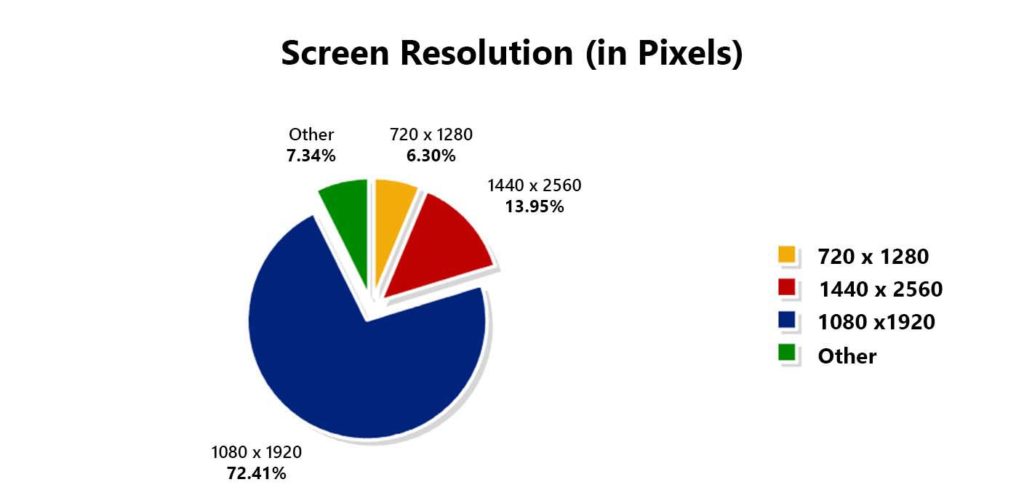

Screen resolution

In this category, it appears that the 1080 x 1920 resolution remains the most popular segment of the market, dominating at 72.41%, followed by 1440p and 720p displays.

We are not surprised by these results, especially the proportion of the 1080p displays. Many Chinese flagships have kept the favoured 1080p display, such as Xiaomi’s Mi 6 and Huawei’s P10; not to forget the upper-mid smartphones such as the Honor 8 and larger counterparts (“Smartphone Model” Plus). We will be expecting the 1080p camp to remain dominant for the next coming months, primarily due to the affordability and lower impact to battery life.

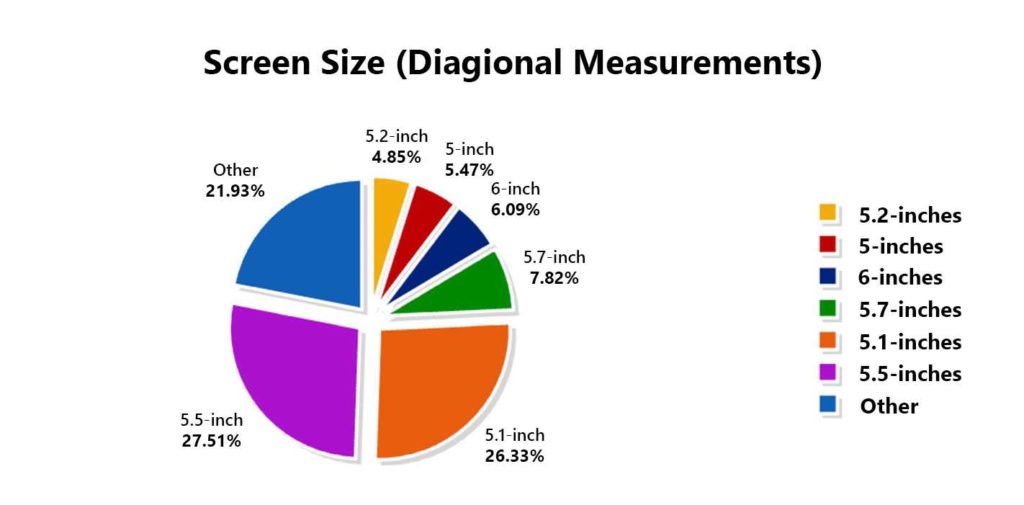

Screen Size

The screen size has a more fragmented market, the highest proportion held by the 5.5-inch screen at 27.51% with the 5.1-inch and 5.7-inch displays coming second and third, respectively.

From the graph beyond the top 3, fragmentation becomes more evident, with 6, 5 and 5.2-inches holding respectable segments also and the remaining 21.93% classified as ‘Others’.

We have mixed views about this, what is clear is that consumers are mostly split between the 5.5-inch and 5.1-inch, however, considering the push for bezel-less screens have become more popular, such as Mi Mix, Nubia, we may also see the increase in screen sizes as consumer may be content with the overall body size of phones but also welcome to increased screen-to-body ratio.

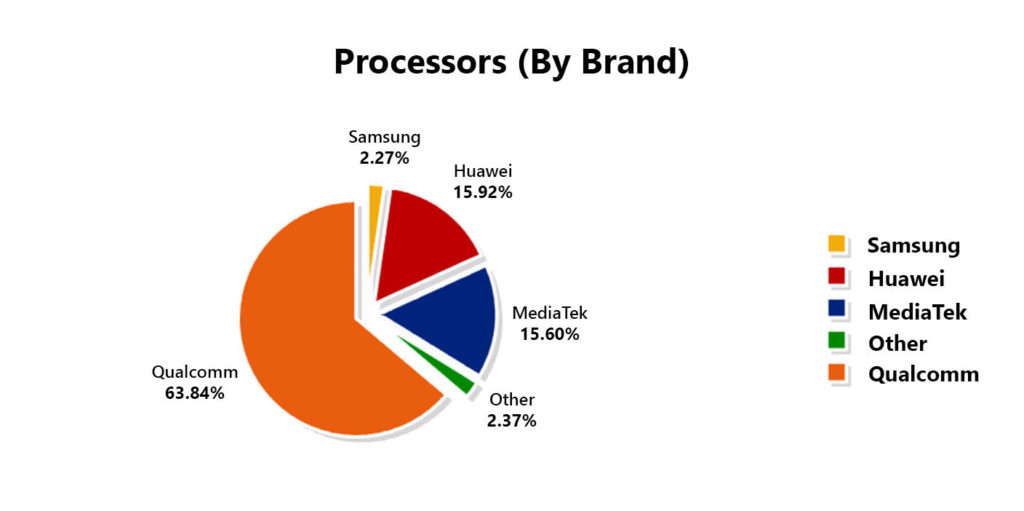

Processors (Brands)

This category shows a greater disproportion in the market, Qualcomm holds monopoly power on the smartphone processor market at 63.84%, whilst the rest is divided by Huawei (15.92%), MediaTek (15.60%), Samsung (2.27%) and other smaller manufacturers.

This hasn’t come to our surprise; the majority of high-end and mid-ranged flagship smartphones are most likely to be powered by a Snapdragon processor. Currently the suspected popular Snapdragon is the 600-series found on many mid to upper-mid ranged devices such as the Oppo R series. Huawei has been doing quite well in relation, due to sales on their Mate-series, P-series and Honor line. MediaTek also provides a healthy number of processor to entry-level to mid-tier smartphones which, judging from the stats, is quite popular as well. We assume that MediaTek has a lower market share currently due to the delayed launch of the anticipated Helio X30.

The results showing the distribution of smartphone processors, by brand, seems quite alarming for people who prefer to have more choice. According to recent articles manufacturers such as Samsung are eager to expand their own branded CPU lines to compete against Qualcomm.

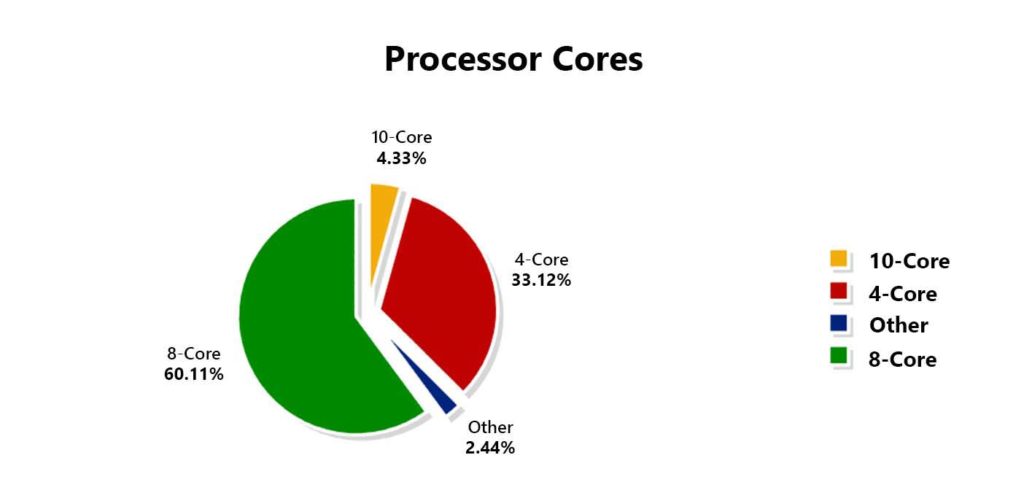

Processor Cores

Expanding from the processor, the distribution of processor cores is less complex. 8-core processors hold a comfortable 60.11% of the market, 33.12% for 4-core processors, 4.33% for 10 cores and the remaining lot at 4.33%

Current and many other 2017 flagships are expecting to run with the Snapdragon 835, Kirin 960 or Helio X30 (the latter not being an 8-core processor) by end of the year.

We believe the 4-core segment is holding its relative large margin is because of the Snapdragon 820 series, found in smartphones like the Mi 5(s), OnePlus 3(T), and Axon 7. The lack of 8-cores in this series was due to the backlash from the Snapdragon 810’s issues. By the end of this year, we are expected to see a fall in the 4-core segment due to the upcoming release of more 8-core and above, smartphones.

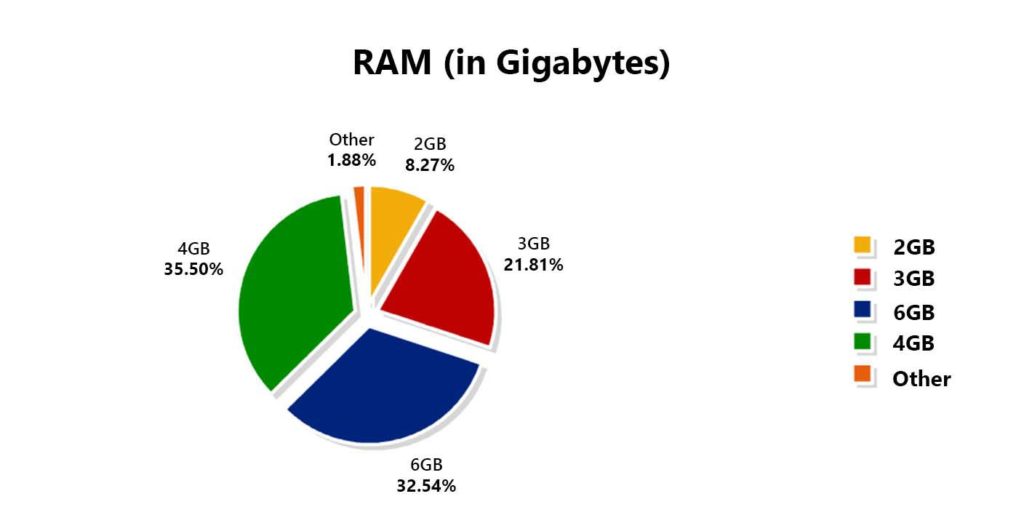

RAM

The number of RAM has increased greatly since the past three years. 4GB RAM currently holds the majority at 35.50% however close to heels is 6GB with 32.54%, with 3GB, 2GB and Others trailing behind.

We will certainly see a change in this category of the market, where we would expect a new significant segment, the 8GB, to rise due to the production of high-end devices’ integration. Anything below 4GB will begin to diminish in market share, whilst the 6GB may hold a majority for the remaining half of the year.

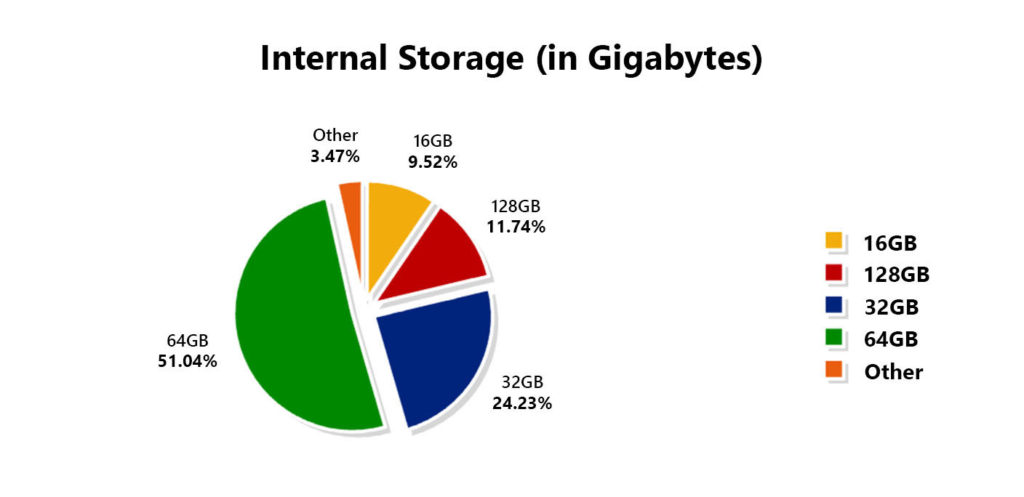

Internal Storage

Alongside the increase of RAM, internal storage has also increased size. The current most popular option is 64GB taking 51.04% of the market with the 32GB following at 24.23%.

The statistics have provided an optimistic future for smartphones’ internal storage. The trend of raising internal storage is certainly welcomed. With more high-end phones aiming to provide bleeding edge specifications, we will be expecting the 128GB to supersede the market share of the 32GB very soon.

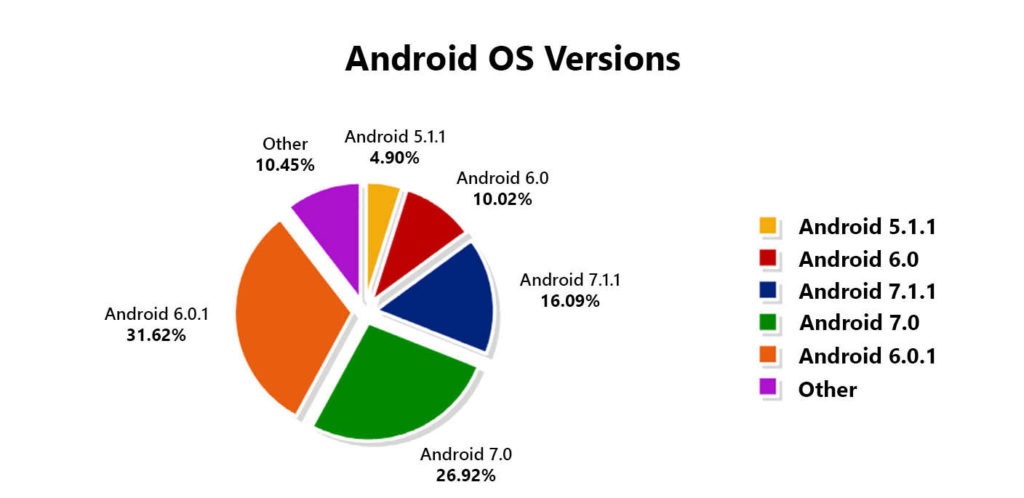

Android OS

We all know the Android ecosystem is not the best at providing a cohesive collection of the latest software.

From the graph, we can see Android 6.0.1 remains the most popular at 31.62%, 7.0 at 26.92%, 7.1.1 at 16.09%; the remaining either version 6.0 or below.

We understand the Android Ecosystem is fragmented and judging from Android’s record we will expect this to continue, with Android 7.0 variants to slowly replace Android 6.0 variants. A concern with such fragmentation is the potential of being at risk to exploits in the future.

What do you think about the AnTuTu Report last month? What changes would most likely change by next month? Share your thoughts and comment down below.

(Source,)