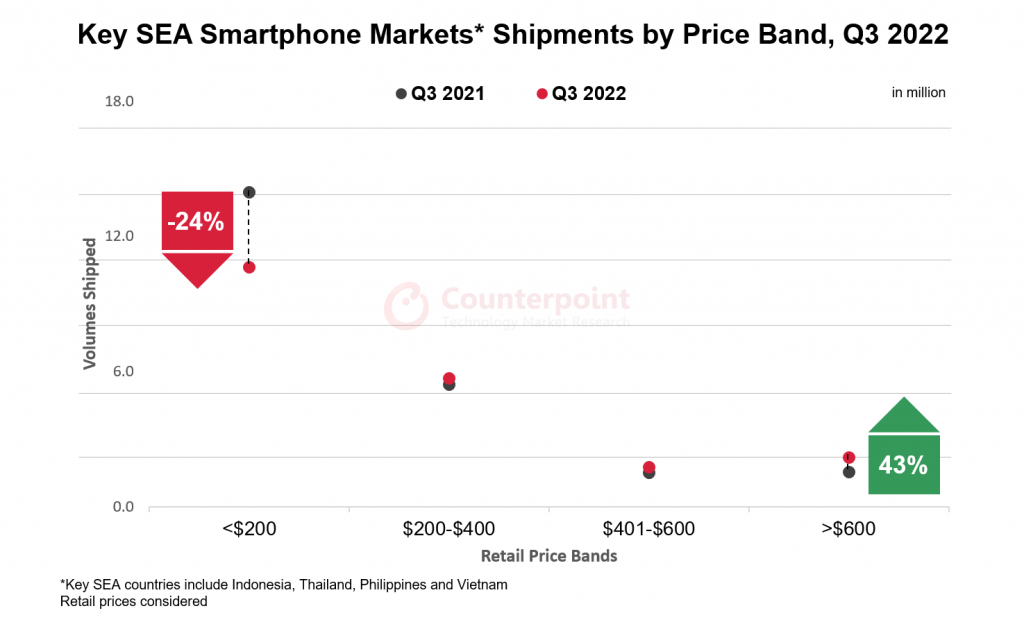

The smartphone market continues to grow. The biggest contributor to this growth is usually mid-range and entry-level models, but according to the latest report from Counterpoint, the number of premium smartphone users in Southeast Asia is increasing significantly. The region’s shipment of premium smartphones (more than $400) increased 29% year-on-year in the third quarter of 2022.

Premium smartphone shipments grow 29% year-on-year in Q3 2022 in Southeast Asia markets

According to Counterpoint Research’s Southeast Asia Monthly Smartphone Channel Share Tracker, premium smartphone shipments (more than $400) in Southeast Asia increased 29% year-on-year in the third quarter of 2022. iPhone 14 series and the other flagship models have a large share in this rise. Unfortunately, the high sales of expensive phones could not prevent the decline in the market.

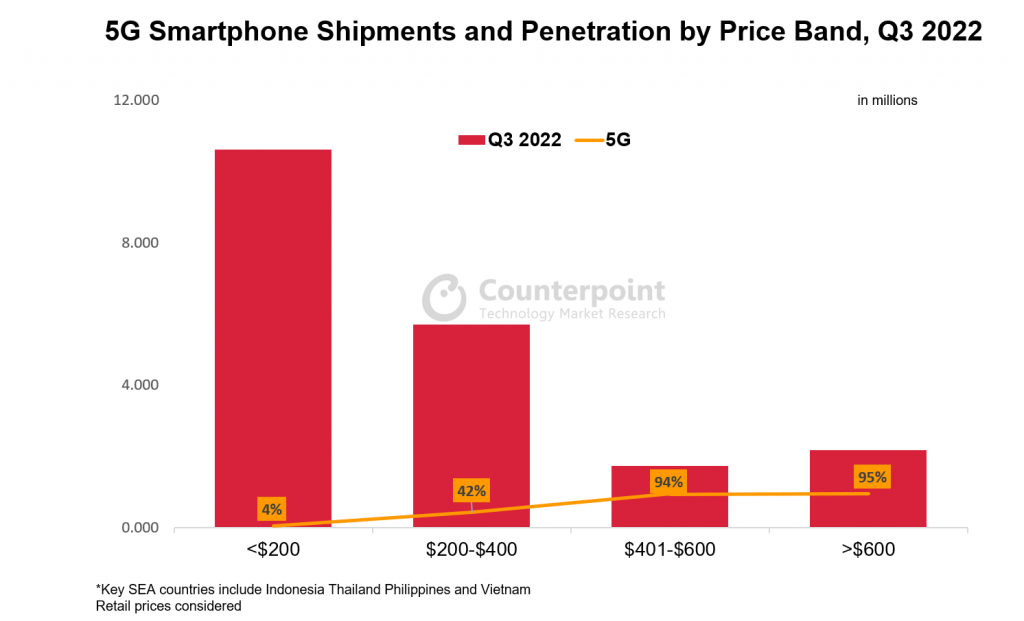

Samsung shipments fell 13% year-on-year, while Apple’s shipments rose 63% year-on-year in all major countries. 5G technology was another factor affecting sales in some regions. Demand for 5G is slow in some countries such as Indonesia and Vietnam, while it is much faster in Thailand and the Philippines, where the network is better. However, features such as the processor, RAM, internal storage, battery capacity and charging speed are much more important for users. Most people look at these features while shopping and choose the most suitable model for them.

Total smartphone shipments fell 10%

Total smartphone shipments fell 10% year-on-year in the third quarter. Economic problems are behind the decline; Southeast Asia is still facing macroeconomic headwinds, and some countries’ investments have slowed down, including FDİ (foreign direct investment) volumes. Unfortunately, the high sales expectation in September was also not met, but positive developments are expected in the last quarter due to Black Friday.

Commenting on the economy, Senior Analyst Glen Cardoza said, “Most Southeast Asian countries like Indonesia, Thailand and Philippines raised interest rates in Q3 2022 to ease the blow of rising prices on the common consumer. Inflation during the quarter was an average 5% in most SEA countries, which is not alarming but did take its toll on consumers.

“Prices for fuel, overall logistics and staple items went up, causing consumers to hold on to their wallets and defer big expenses like smartphones. The majority of such consumers are blue-collar workers or from economically weaker sections. While a country like Thailand is struggling to regain pre-COVID volumes due to depleted tourism levels, Vietnam has shown a 13% GDP growth in Q3. The effect of the same is reflected in the smartphone shipments in the last few months.”

- Indonesia’s Smartphone Shipments Drop 21% But OPPO Retains the Lead

- Samsung Reportedly Plans To Reduce Its Smartphone Shipments By 13%

- Global smartphone shipments fall in Q3 2022; only Apple grows year-on-year

- India notices a 5% QoQ decline in smartphone shipments, Xiaomi leads the race in…

- Global Smartphone Shipments Going Downhill in Q2 2022, Samsung Retains the Lead

(Source)