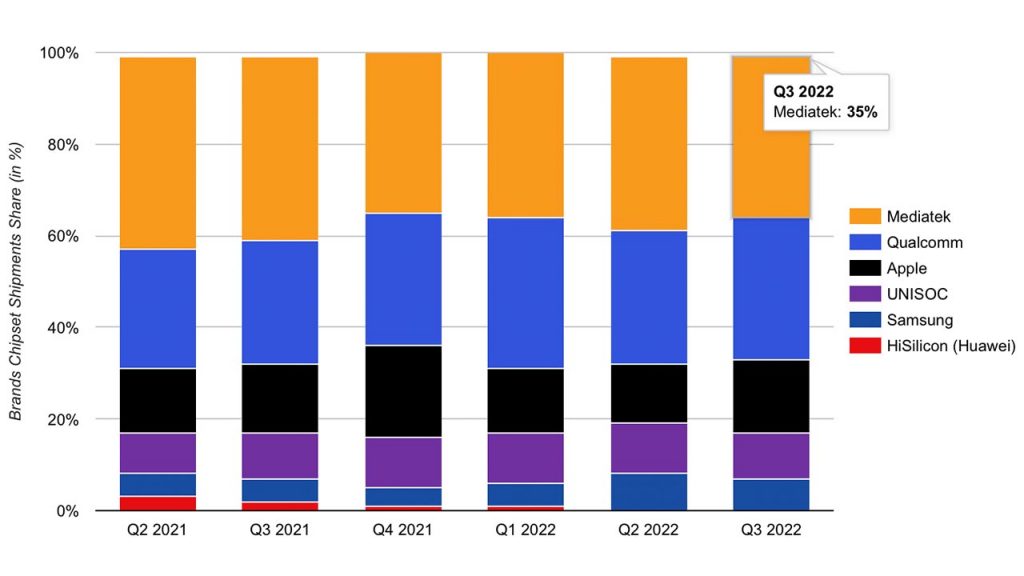

Competition in the smartphone chipset market is fierce, as companies strive to be leaders in performance and market share. Qualcomm and Apple are currently the frontrunners in terms of power, but MediaTek still holds the market share lead, according to data from COUNTERPOINT’s Global Smartphone Application Processor (AP) Market Share research. Here are the details…

MediaTek maintains market share lead as Qualcomm and Apple lead in Power in the smartphone chipset market

MediaTek has maintained a steady market share of around 35-40% in recent quarters, thanks to the success of its Dimensity 9200 SoC in the premium segment and partnerships with major Chinese OEMs like Vivo and Oppo. However, the overall market is expected to slow in Q4 2022 due to order cuts from major Chinese OEMs, ongoing customer inventory adjustments, global macroeconomic conditions, and the weak China market.

Qualcomm has seen a slight increase in market share, with 27% in Q3 2021 and 31% in Q3 2022. The company’s Snapdragon chipsets are highly regarded in the premium segment, and Qualcomm has recently announced a partnership with Samsung for the Galaxy S23 family. However, Qualcomm’s market share is expected to decline in Q4 2022 due to global macroeconomic conditions, a slowdown in consumer product purchases, and weak demand from Chinese OEMs.

Apple‘s market share saw a significant boost in Q4 2021 and Q2 2022, due to the launch of the new iPhone 14 pro and its variants with the A16 bionic chipset. The Pro models have been particularly successful, and there have been some issues with manufacturing in China due to the resurgence of COVID-19. As a result, Apple’s chipset shipments are expected to increase in Q4 2022. (Note: Totals may not add up due to rounding.)

| Global Smartphone Chipset Market Share (Q2 2021 – Q3 2022) | ||||||

| Brands | Q2 2021 | Q3 2021 | Q4 2021 | Q1 2022 | Q2 2022 | Q3 2022 |

| Mediatek | 42% | 40% | 35% | 36% | 38% | 35% |

| Qualcomm | 26% | 27% | 29% | 33% | 29% | 31% |

| Apple | 14% | 15% | 20% | 14% | 13% | 16% |

| UNISOC | 9% | 10% | 11% | 11% | 11% | 10% |

| Samsung | 5% | 5% | 4% | 5% | 8% | 7% |

| HiSilicon (Huawei) | 3% | 2% | 1% | 1% | 0% | 0% |

RELATED:

- iQOO 11 Live Shots Emerge to Showcase Front, Rear Design & Key Specs

- New Mediatek Dimensity 8200 Chip Debuting in China on December 8

- Bullitt and MediaTek to launch world’s first satellite-to-mobile messaging smartphone in Q1 next year

- MediaTek Dimensity 8200 SoC confirmed to go official on December 1

- Tecno, Counterpoint, MediaTek, and Editor-At-Large of Forbes Magazine, To Discuss Evolution of Premium Smartphones…

(source)